In 2005, a group of students from the University of Kansas met with Warren Buffett. Their first question was whether he would still be able to earn investment returns of 50% annually. Buffett responded:

“Yes, I would still say the same thing today. In fact, we are still earning those types of returns on some of our smaller investments. The best decade was the 1950s; I was earning 50% plus returns with small amounts of capital. I could do the same thing today with smaller amounts. It would perhaps even be easier to make that much money in today’s environment because information is easier to access.

“You have to turn over a lot of rocks to find those little anomalies. You have to find the companies that are off the map - way off the map. You may find local companies that have nothing wrong with them at all. A company that I found, Western Insurance Securities, was trading for $3/share when it was earning $20/share! I tried to buy up as much of it as possible. No one will tell you about these businesses. You have to find them.”

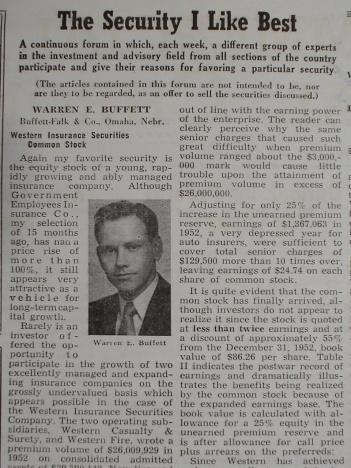

Recently I was lucky enough to find an old article Buffett wrote about Western:

Again my favorite security is the equity stock of a young, rapidly growing and ably managed insurance company. Although Government Employees Insurance Co., my selection of 15 months ago, has had a price rise of more than 100%, it still appears very attractive as a vehicle for long-term capital growth.

Rarely is an investor offered the opportunity to participate in the growth of two excellently managed and expanding insurance companies on the grossly undervalued basis which appears possible in the case of the Western Insurance Securities Company. The two operating subsidiaries, Western Casualty & Surety and Western Fire, wrote a premium volume of $26,009,929 in 1952 on consolidated admitted assets of S29,590,142. Now licensed in 38 states, their impressive growth record, both absolutely and relative to the industry, is summarized in Table I below.

Western Insurance Securities owns 92% of Western Casualty and Surety, which in turn owns 99.95% of Western Fire Insurance. Other assets of Western Insurance Securities are minor, consisting of approximately $180,000 in net quick assets. The capitalization consists of 7,000 shares of $100 par 6% preferred, callable at $125; 35,000 shares of Class A preferred, callable at $60, which is entitled to a $2.50 regular dividend and participates further up to a maximum total of $4 per share; and 50,000 shares of common stock. The arrears on the Class A presently amount to $36.75.

The management headed by Ray DuBoc is of the highest grade. Mr. DuBoc has ably steered the company since its inception in 1924 and has a reputation in the insurance industry of being a man of outstanding integrity and ability. The second tier of executives is also of top caliber. During the formative years of the company, senior charges were out of line with the earning power of the enterprise. The reader can clearly perceive why the same senior charges that caused such great difficulty when premium volume ranged about the $3,000,000 mark would cause little trouble upon the attainment of premium volume in excess of $26,000,000.

Adjusting for only 25% of the increase in the unearned premium reserve, earnings of $1,367,063 in 1952, a very depressed year for auto insurers, were sufficient to cover total senior charges of $129,500 more than 10 times over, leaving earnings of $24.74 on each share of common stock.

It is quite evident that the common stock has finally arrived, although investors do not appear to realize it since the stock is quoted at less than twice earnings and at a discount of approximately 55% from the December 31, 1952 book value of $86.26 per share. Table II indicates the postwar record of earnings and dramatically illustrates the benefits being realized by the common stock because of the expanded earnings base. The book value is calculated with allowance for a 25% equity in the unearned premium reserve and is after allowance for call price plus arrears on the preferreds.

Since Western has achieved such an excellent record in increasing its industry share of premium volume, the reader may well wonder whether standards have been compromised. This is definitely not the case. During the past ten years Western’s operating ratios have proved quite superior to the average multiple line company. The combined loss and expense ratios for the two Western companies as reported by the Alfred M. Best Co. on a case basis are compared in Table III with similar ratios for all stock fire and casualty companies.

The careful reader will not overlook the possibility that Western’s superior performance has been due to a concentration of writings in unusually profitable lines. Actually the reverse is true. Although represented in all major lines, Western is still primarily an automobile insurer with 60% of its volume derived from auto lines. Since automobile underwriting has proven generally unsatisfactory in the postwar period, and particularly so in the last three years, Western’s experience was even more favorable relative to the industry than the tabular comparison would indicate.

Western has always maintained ample loss reserves on unsettled claims. Underwriting results in the postwar period have shown Western to be over-reserved at the end of each year. Triennial examinations conducted by the insurance commissioners have confirmed these findings.

Turning to their investment picture, we of course find a growth in invested assets and investment income paralleling the growth in premium volume. Consolidated net assets have risen from $5,154,367 in 1940 to their present level of $29,590,142. Western follows an extremely conservative investment policy, relying upon growth in premium volume for expansion in investment income. Of the year-end portfolio of $21,889,243, governments plus a list of well diversified high quality municipals total $20,141,246 or 92% and stocks only $1,747,997 or 8%. Net investment income of $474,472 in 1952 was equal to $6.14 per share of Western Insurance common after minority interest and assuming senior charges were covered entirely from investment income.

The casualty insurance industry during the past several years has suffered staggering losses on automobile insurance lines. This trend was sharply reversed during late 1952. Substantial rate increases in 1951 and 1952 are being brought to bear on underwriting results with increasing force as policies are renewed at much higher premiums. Earnings within the casualty industry are expected to be on a very satisfactory basis in 1953 and 1954.

Western, while operating very profitably during the entire trying period, may be expected to report increased earnings as a result of expanding premium volume, increased assets, and the higher rate structure. An earned premium volume of $30,000,000 may be conservatively expected by 1954. Normal earning power on this volume should average about $30.00 per share, with investment income contributing approximately $8.40 per share after deducting all senior charges from investment income.

The patient investor in Western Insurance common can be reasonably assured of a tangible acknowledgement of his enormously strengthened equity position. It is well to bear in mind that the operating companies have expanded premium volume some 550% in the last 12 years. This has required an increase in surplus of 350% and consequently restricted the payment of dividends. Recent dividend increases by Western Casualty should pave the way for more prompt payment on arrearages. Any leveling off of premium volume will permit more liberal dividends while a continuation of the past rate of increase, which in my opinion is very unlikely, would of course make for much greater earnings.

Operating in a stable industry with an excellent record of growth and profitability, I believe Western Insurance common to be an outstanding vehicle for substantial capital appreciation at its present price of about 40. The stock is traded over-the-counter.

Wow haha, this blog is about exactly what I thought it would be about.

To set up blog stats… You have to goto your administration dashboard, and then click on the presentation button, then click on widgets, and there you can arrange the sidebar if the theme you picked has one. I have a widget called blog stats so I dragged it into the sidebar.

I think you can also see your blog stats in the administration dashboard. Well since the site is new, it’s going to take awhile for people to find it.

If you want to get more traffic you have to tag your posts with popular tags, and make it so your blog can be indexed by search engines. Surf WordPress for popular tags like investments, stocks, or other commonly used tags.

Thanks a lot.

In Buffett’s 1994 shareholder letter he mentions a report he wrote on a company called IDS that he bought in 1953 at a p/e ratio of 3. Have you come across that in your findings?

Thanks, Will. I had not heard about IDS until after reading your comment. In the letter, Buffett writes:

It doesn’t seem that the report was on IDS. However when I return to school in September, I will check my sources.

Yesterday I went through an entire shelf of C&FC issues covering the years 1952 to 1954. I did not find any more articles written by Warren Buffett. Maybe the WSJ archived his ad.

I would like to see a continuation of the topic

Maximus,

Western Insurance Securities, an historically profitable company, was selling at less than two times earnings and at less than half of asset value. It isn’t possible to find opportunities like this anymore. A short history lesson on stock valuation might tell us why.

Prior to the late 1920s, stock prices approximated asset values. By 1929, however, primary emphasis had switched to earning power, and asset values were essentially ignored. (Investors as a whole bought the idea that future performance could differ so much from past performance that asset values were irrelevant.) This logic led to severe overvaluations and equally severe subsequent declines.

By 1933, many issues (I think 20% of the Moody’s manual) were selling below liquidation value. Ben Graham wrote a prophetic article around this time titled “Is American Business Worth More Dead Than Alive?”. He and his colleague, Jerome Newman, bought stocks selling for less than their net working capital and liquidated most of the companies. The strategy worked very well, and it firmly established the margin of safety, buy-at-a-discount philosophy. Obviously the success of this approach has diminished because many people practice it.

[...] Market Efficiency & Munger Investing In 1952, Warren Buffett made a concentrated bet on Western Insurance Securities. At half of book value and two times earnings, there was tremendous upside and no downside. By [...]

[...] by Warren Buffett (Published 1951) (PDF File) (HTML) [...]